UvA enters into an agreement with the University of Cape Town to design fair, efficient and fraud-proof tax systems

12 May 2022

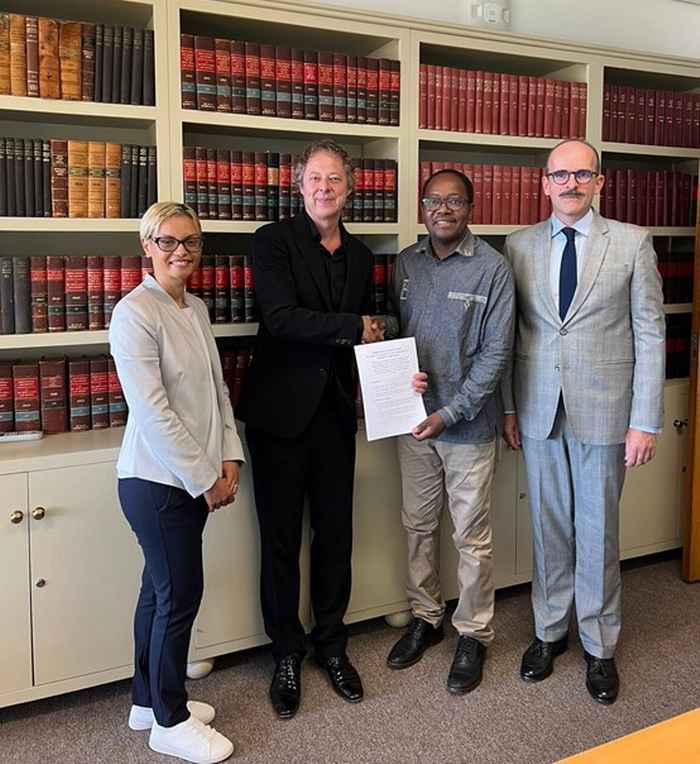

The Amsterdam Centre for Tax Law (ACTL) of the UvA has recently signed an agreement with the University of Cape Town to research about the design of more fair, efficient and fraud-proof tax systems. The research to be conducted falls under the umbrella of the UvA’s project “Designing the tax system for a Cashless, Platform-based and Technology-driven society” (CPT project)

About the CPT project

Whenever major economic or social changes occur, tax systems must follow suit. Working from the assumption that society is in the process of transitioning to a new economic model, accelerated by the corona crisis, the CPT project examines how tax systems can be designed and structured for a society based primarily on cashless payment methods, online platforms and digital technologies, such as artificial intelligence and blockchain. The ultimate goal is to arrive at concrete recommendations that not only help different stakeholders – such as governments and commercial organisations – address problems under current tax systems and/or introduce structural tax reforms, but also provide guidelines and/or minimum standards for the redesign of modern tax systems.

The partnership

The objective of both the UvA and the University of Cape Town is to combine their strengths and expertise to come up with the building blocks – based on scientific research – for making tax systems fairer, more efficient and difficult to circumvent. An important feature of this research collaboration is that it pays special attention to the perspectives and interests of developing countries of the African continent.

Associate Professor dr. Afton Titus, Director of Internationalisation and Outreach from the University of Cape Town, comments: “This project is exciting in its possibility to move tax systems, particularly African countries’ tax systems, into the future. Cashless payment methods represent an opportunity for academics, policy makers and revenue authorities to adapt and possibly redesign existing tax systems to better meet the challenges of a global, digital economy. The collaboration between the University of Cape Town and the University of Amsterdam is a well-timed step in meeting those challenges head-on.”

Professor dr. Dennis Weber, Director of the CPT project, comments: “The partnership with the University of Cape Town is a very important step for both the UvA and CPT project as it provides an opportunity to work collaboratively with this leading academic institution of the African continent. This will allow us to both learn from the experiences and practical problems faced by African tax systems and to contribute with our own know how in order to better address them. Working on academic research and activities together with the University of Cape Town will be an exciting challenge for us as European academics. This partnership and the overall research that we conduct under the CPT project, puts the University of Amsterdam at the heart of the global society”.

Growing number of partnerships

As an independent and inclusive initiative, the CPT project is open to governments, NGOs and companies that want to contribute to it. In addition to the support of the University of Cape Town and other partners like the Tax Authorities of the City of Buenos Aires (AGIP), Ernst & Young (EY), Microsoft, Netflix and NEXI Group, more partners are expected to join the CPT project in the coming months.

The initiative is also supported by the Dutch Association of Tax Advisers (NOB), the Dutch branch of the International Fiscal Association (IFA) and several law firms: Gatti Pavesi Bianchi Ludovici, Loyens & Loeff, Maisto e Associati. Part of the project is financed through the National Sector Plan Law 2019-2025, within Digital Legal Studies. The project is also part of the Digital Transformation of Decision-Making initiative of the Amsterdam Law School.

More information:

- CPT-project: https://actl.uva.nl/cpt-project/cpt-project.html

- Amsterdam Centre for Tax Law - ACTL

- Amsterdam Law School: https://www.uva.nl/en/about-the-uva/organisation/faculties/amsterdam-law-school/amsterdam-law-school.html

Contacts

- Prof. dr. Dennis Weber, Director of the ACTL and CPT project’s General Supervisor, e-mail: d.m.weber@uva.nl

- Juan Manuel Vázquez, Academic Coordinator of the CPT project; j.m.vazquez@uva.nl